When the cryptocurrency sector started taking off, the number of venues for exchanging BTC for conventional cash or tangible commodities was limited, and P2P transactions using the Bitcointalk forum were the norm.

These transactions were inherently risky, but the value of a Bitcoin was almost negligible in those days, so putting your money on the line by trusting a stranger and investing in Bitcoin was not a major risk. Fast forward to 2023, and more regulated, and more trustworthy exchanges have dominated the global crypto market by adhering to stringent Know Your Customer (KYC), Anti-Money Laundering (AML), and Counter-Terrorism Financial (CTF) rules.

Trading cryptocurrency is becoming one of the most lucrative markets in the fintech sector. It is common for traders to lose money; therefore, understanding the different trading instruments available might help them mitigate losses.

This article will examine the different order types used in cryptocurrency trading and their utility based on the crypto market structure and conditions.

What is an order type?

Trading may be defined as the transfer of ownership of an asset from one party to another. A trade order is an agreement to buy or sell an asset like Bitcoin at a specific price or within a given price range. An order can be either a buy or sell order, as traders comprise buyers and sellers.

The different kinds of order types available to traders allow them to either profit from or hedge against market volatility. In other words, the different order types let traders fine-tune their trading experience based on their trading goals.

Both cryptocurrency and traditional stock market traders use various order types and operate similarly in both scenarios.

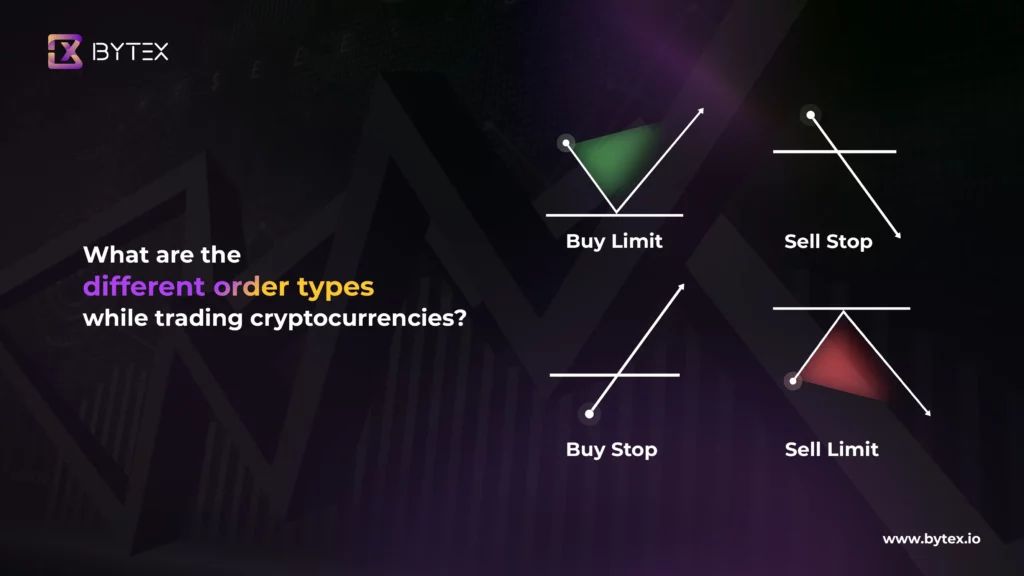

There are primarily two different types of orders:

- Market orders

- Limit orders

What is a market order in cryptocurrency trading?

A market order is a simple instruction to buy or sell an asset at the current best price on the exchange. That means buying or selling a cryptocurrency at its last traded price. Thus, if the most recent Bitcoin trade occurred at $20,000, the market price for Bitcoin on the exchange is also $20,000.

Market orders, also known as spot orders, are the quickest and most simple orders to execute on an exchange. You only need to type in the amount of cryptocurrency you want to buy or sell. Then the market will find a matching order in its order book for you.

You will incur a “taker fee” from the exchange since you are using up available stock in the order book. Market orders are effective when speed is more important than price. In other words, use market orders only if you need to buy or sell anything immediately, regardless of price and fees.

Cryptocurrency prices may fluctuate across different marketplaces. This is because every exchange operates its own market for cryptocurrencies. However, there is often little difference in market pricing across exchanges for major cryptocurrencies.

Some investors, known as “arbitrageurs,” make a living by taking advantage of slight price differences across markets. As a result of crypto arbitrage trading, price differences are swiftly evened out.

What is a limit order in cryptocurrency trading?

With limit orders, you can specify a price you want to buy or sell a cryptocurrency. If you want to buy or sell anything on the exchange, you will need to set a maximum price at which you are willing to do so.

You might, for instance, set a limit order to buy exactly one bitcoin at $10,000. If you think the price of bitcoin will drop to $10,000 and want to acquire some as soon as it gets there, this is a helpful tool. Alternatively, you may set a limit order to sell a single bitcoin for no less than $20,000. That is helpful if you plan to sell your bitcoin as soon as its price surpasses $20,000.

Limit orders let buyers and sellers transact at a predetermined price. As a result, they may profit from price changes without constantly monitoring the market.

The risk with limit orders is that they may only be fulfilled if the cryptocurrency price is within the threshold you set. However, executing these trades will save you money since the “maker fee” is usually lower than the “taker fee.” A “maker fee” is levied by exchanges for orders that are not filled immediately and are added to the orderbook.

Difference between market order and limit order in cryptocurrency trading

What are stop orders in cryptocurrency trading?

Another variation of a non-instant order type is stop orders. They differ from limit orders in that they include a predetermined price at which the order will only be triggered and not executed. In addition, a limit order is visible to the market, but a stop order is only visible once it is executed.

A stop order buys or sells a cryptocurrency once it hits the predetermined stop price. At that point, the order is treated as a market order and fulfilled at the market’s current price.

Market participants can use this order type to safeguard profits and minimize losses. However, similar to limit orders, market orders do not guarantee execution.

There are two types of stop orders; limit and market orders. If the market price reaches a certain level (the stop price), the stop market order will be filled instantly. Meanwhile, stop-limit orders are a little more complicated.

What are stop-limit orders in crypto trading?

As an extension of limit orders, stop-limit orders give the trader even more flexibility. As soon as the stop price is achieved, the stop-limit order is triggered to buy or sell the cryptocurrency, and the trade is sustained until the entire order is completed.

The benefit of choosing a stop price is that the order will not be filled at a lower price, giving traders perfect control over how their order is executed.

For instance, setting a stop price for buying Bitcoin at $20,000 triggers the order when the set price is hit. If the investor thinks the price will go up, they can specify a maximum limit price of $20,100, at which point the asset will only be purchased if it goes higher.

Similarly, let’s say you have $20,000 set as your limit for selling Bitcoin. When the price reaches this level, the trader’s sell order is triggered, and if he expects the price to drop further, he may set a minimum limit price of $19,000, at which the asset will be sold to avoid losses.

One advantage of this order type is that if the order is not entirely filled, the remaining balance will be placed as an open order at $19,000.

What are stop-loss orders in crypto trading?

Stop-loss orders are especially beneficial for day traders by letting them step away from their screens for a while. They function similarly to stop-limit orders in that they have a stop price and a loss price.

For example, suppose traders wish to sell a cryptocurrency and the trending scenario is bearish, indicating that the price appears to be heading down significantly. In that case, the stop price can be placed at $20,000 and the loss at $19,500 to limit losses.

Depending on the market’s direction, experienced traders will either raise or reduce the stop loss. Traders can mitigate the effects of loss by tailoring their management structure to the market’s characteristics.

What are trailing stop-loss orders in crypto trading?

With a trailing stop order, investors can place a limit order at a specified percentage below or above the current market price. It aids investors in protecting their capital and minimizing their losses when a trade does not go in the investor’s desired way.

The trailing stop is raised by a predetermined amount when the price goes in a positive direction. Profits are protected since the transaction can stay open and generate more income if the price goes in the desired direction. If the price goes the other way by a specified percentage, the trailing stop will trigger an automatic exit from the transaction at the current market price.

Advanced order types

It should now be evident that buy market orders, sell market orders, buy-limit orders, and sell-limit orders are the simplest order types. However, relying only on these might limit a trader’s opportunities. To take advantage of the market, seasoned traders build upon these and use other advanced forms of order types for both short-term and long-term setups.

What is an Iceberg Order (IO) in cryptocurrency trading?

The purpose of iceberg orders is to disguise the actual size of an order by dividing it into many smaller limit orders. The “Iceberg” referred to in the expression “tip of the iceberg” is the visible lots, not the vast majority of limit orders. They are also known as “reserve orders.”

Institutional investors use iceberg orders to buy and sell large amounts of crypto without drawing market attention. Only a tiny fraction of their overall order is displayed on order books at any given time.

An iceberg order minimizes price swings in the market by masking large order amounts. This is because when these orders appear in the order book, they generally serve as a strong support or resistance, which day traders may exploit.

What is a hidden order (HO) in cryptocurrency trading?

Investors who place large orders often hide their identities for several reasons. In such cases, traders use hidden orders. Using a hidden order, a trader can conceal the volume of buy and sell transactions for large sums of cryptocurrency. This order does not show up in the order book.

Similar to iceberg orders, they are typically utilized by large financial institutions. Instead of breaking up the enormous order into several smaller ones, it is hidden. The goal here is to avoid creating a panic in the market.

What is a one-cancels-the-other (OCO) order in cryptocurrency trading?

OCO order is a complex technique for combining two conditional orders in which one cancels out the other. Each operates independently of the other until one is activated. So, if Bitcoin were at $40,000, you could put in an OCO order to buy when it reaches $49,000 or sell when it reaches $51,000. When one of these two is put into action, the other will be scrapped.

Closing note

As outlined above, a basic grasp of the most common order types is essential whether you want to make a quick investment in cryptocurrency or make trading cryptocurrency a regular part of your routine, primarily since every order type caters to a unique scenario and trading style.

Important Disclosures:

Certain statements in this document might be forward-looking statements, including those identified by the expressions “anticipate”, “believe”, “plan”, “estimate”, “expect”, “intend”, “target”, “seek”, “will” and similar expressions to the extent they relate to the material produced by Bytex staff member. Forward-looking statements are not historical facts but reflect the current expectations regarding future results or events. Such forward-looking statements reflect current beliefs and are based on information currently available to them. Forward-looking statements are made with assumptions and involve significant risks and uncertainties. Although the forward-looking statements contained in this document are based upon assumptions the author of the material believes to be reasonable, none of Bytex’s staff can assure potential participants and investors that actual results will be consistent with these forward-looking statements. As a result, readers are cautioned not to place undue reliance on these statements as a number of factors could cause actual results or events to differ materially from current expectations

The commentaries contained herein are provided as a general source of information based on information available as of MMMM DD, 2022. Every effort has been made to ensure accuracy in these commentaries at the time of publication; however, accuracy cannot be guaranteed. Market conditions may change investment decisions arising from the use or relevance of the information contained here. ByteX. makes no representation or warranty to any participant regarding the legality of any investment, the income or tax consequences, or the suitability of an investment for such investor. Prospective participants must not rely on this document as part of any assessment of any potential participation in buying and selling of virtual currency assets and should not treat the contents of this document as advice relating to legal, taxation, financial, or investment matters. Participants are strongly advised to make their own inquiries and consult their own professional advisers as to the legal, tax, accounting, and related matters concerning the acquisition, holding, or disposal of a virtual currency. All content is original and has been researched and produced by ByteX.